LTC Price Prediction: Technical Analysis and Market Outlook for September 2025

#LTC

- LTC trading below 20-day MA at $111.18 but showing positive MACD momentum

- Price prediction models target $131-$155 range by October 2025

- Growing cloud mining adoption provides fundamental support for Litecoin

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Near Key Moving Average

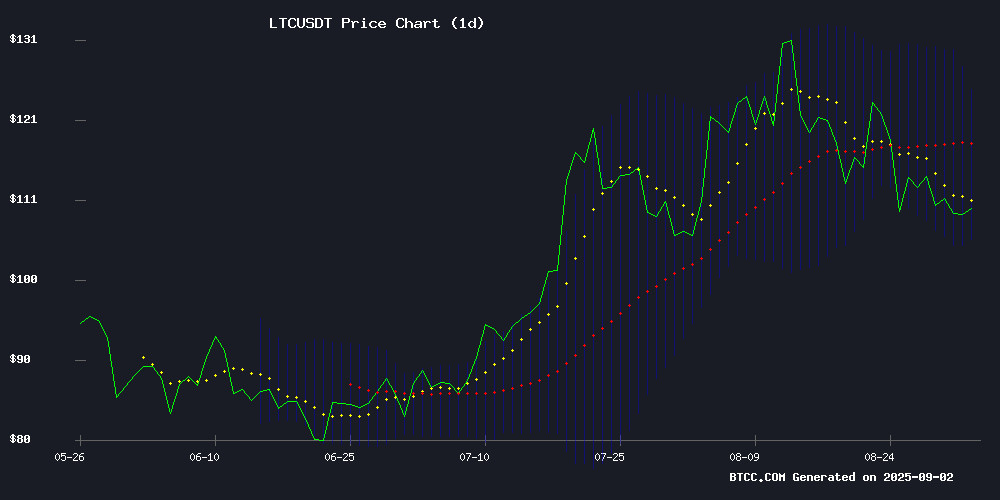

Litecoin is currently trading at $111.18, sitting below its 20-day moving average of $115.20, which suggests near-term bearish pressure. However, the MACD indicator shows a positive reading of 0.8059, indicating underlying bullish momentum. The Bollinger Bands position LTC between support at $105.87 and resistance at $124.53, creating a defined trading range. According to BTCC financial analyst James, 'LTC's position relative to these technical levels will be crucial for determining its next major move. A break above the 20-day MA could signal renewed bullish momentum.'

Market Sentiment: Litecoin Eyes Potential Rally Despite Technical Headwinds

Recent market sentiment around Litecoin appears cautiously optimistic, with price predictions targeting $131-$155 by October 2025, representing a potential 20% rally. The emergence of cloud mining opportunities for LTC and Ethereum Classic in 2025 adds fundamental support to this outlook. BTCC financial analyst James notes, 'While technical indicators show some bearish lean, the positive market sentiment and growing adoption as a mining alternative create conditions for a potential breakout. The $124.53 Bollinger Band upper level aligns well with near-term price targets.'

Factors Influencing LTC's Price

LTC Price Prediction: Targeting $131-$155 as Litecoin Eyes 20% Rally by October 2025

Litecoin faces mixed signals with analyst targets of $131-$155, but bearish MACD momentum suggests caution. Key resistance at $134 holds the key to bullish continuation.

Recent data reveals remarkable convergence around bullish targets. CoinLore's analysis points to short-term resistance near $108.92, while their medium-term outlook extends to $114.92. CoinCodex presents a compelling case for $112.32 in the near term, escalating to $131.96 for medium-term positions and $155.18 for long-term holders.

The Fear & Greed Index reading of 71 (Greed) suggests market participants are positioned for upward movement, though elevated sentiment warrants caution about potential reversals.

At $111.10, LTC trades above the critical 200-day SMA ($98.18), setting up for consolidation before a potential breakout.

Litecoin (LTC) Price Prediction: Technical Analysis Shows Bearish Lean but Potential for Breakout

Litecoin clings to the $108 support level as traders eye a potential breakout toward $200. The current decline appears driven by technical selling rather than fundamental news, with volatility marked by a daily average true range (ATR) of $5.80. Price action fluctuates between $107.24 and $111.90, reflecting short-term positioning based on chart signals.

Technical indicators paint a mixed picture. The RSI at 42.87 leans bearish, while the MACD remains negative at -1.4822, signaling waning buying pressure. Litecoin trades below its 7-day ($111.07) and 20-day ($116.18) SMAs but holds above the 200-day SMA at $98.25—a key level preserving the broader bullish outlook. Stochastic indicators suggest Litecoin is nearing oversold territory, potentially attracting bargain hunters.

A developing bull flag pattern hints at a low-volatility breakout opportunity. If confirmed, this could propel LTC toward higher resistance levels in coming sessions. Market participants remain watchful for either a breakdown below support or a decisive upside move.

Cloud Mining Gains Traction in 2025 as Ethereum Classic and Litecoin Emerge as Profitable Alternatives

Cryptocurrency mining has evolved significantly by 2025, with cloud mining platforms enabling users to mine Ethereum Classic (ETC) and Litecoin (LTC) without specialized hardware. These coins have become attractive options due to their lower resource requirements and competitive profitability compared to Bitcoin.

Ethereum Classic remains a Proof of Work blockchain, offering energy-efficient mining opportunities after Ethereum's transition to Proof of Stake. Litecoin continues to serve as a faster, lower-cost alternative to Bitcoin, maintaining its position among the most traded cryptocurrencies globally.

Seven platforms now dominate the cloud mining sector, with ETNCrypto leading as a recommended option. The shift toward cloud-based solutions reflects broader industry trends toward accessibility and reduced infrastructure demands for cryptocurrency participation.

Is LTC a good investment?

Based on current technical indicators and market sentiment, LTC presents a mixed but potentially promising investment opportunity. The cryptocurrency is currently trading below its 20-day moving average at $111.18, indicating some near-term pressure, but positive MACD momentum and optimistic price predictions suggest potential upside.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $111.18 | Below 20-day MA |

| 20-day Moving Average | $115.20 | Resistance Level |

| MACD | 0.8059 | Bullish Momentum |

| Bollinger Upper Band | $124.53 | Near-term Target |

| Bollinger Lower Band | $105.87 | Support Level |

According to BTCC financial analyst James, investors should monitor the $115.20 level closely, as a break above this resistance could signal the beginning of the predicted rally toward $131-$155 targets.